Recent Distressed Baby Bond w/ 50%+ Potential Total Return

- specialsitsresearc

- Aug 6, 2024

- 2 min read

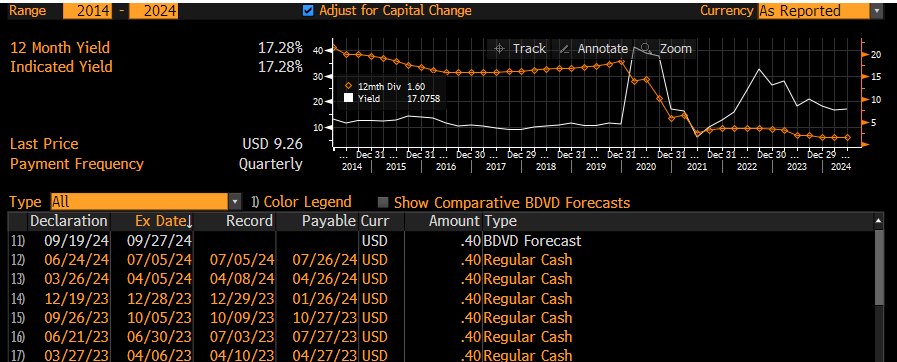

We first shared this name, CTBB (Qwest subsidiary of Lumen) for a 20%+ return last year ($9.00/25.00 or 36c at 18% current yield). At that point in time, the fiber company's Qwest subsidiary generated more than enough cash to cover interest. We just reinvested near our original cost for a round trip last week at ~$10/share, and its already up 34% (>$13/share) on a new catalyst (AI-driven fiber deals). At our new purchase price, it has a 15% annual yield at cost (to be earned over the next year). This is a $25/share par, retail-friendly unsecured bond that trades like a preferred stock, but has a GUC treatment in any potential bankruptcy. The 6.5% unsecured bond pays quarterly ($0.40625/Q, next ex-date 8/30), which equates to a 15% yield between $10-11/share.

Want to read more?

Subscribe to specialsitsresearch.com to keep reading this exclusive post.