65+ Defensive Dividend Aristocrats (Excel Screener Available)

- specialsitsresearc

- Apr 17, 2023

- 1 min read

There are currently 68 dividend aristocrats, up from 65 in 2022 in the S&P 500 (SPX). Dividend aristocrats are required to have 25+ years of consecutive dividend increases. Over the past two years of market volatility, the dividend aristocrats have outperformed the Russell 2000 by 23% and the S&P 500 by 3% BEFORE DIVIDENDS.

This screen of 68 names could be useful to find attractive, low-beta stocks when the market sells off in the 2nd half of the year on weak earnings, a weak consumer, and recession fears.

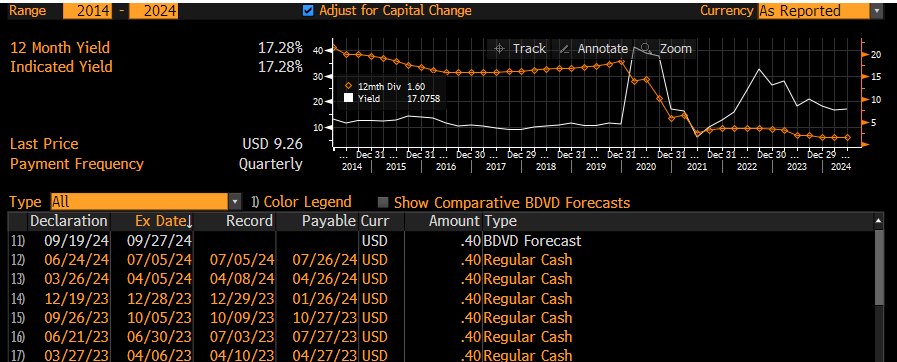

The three additions to the aristocrats in 2023 were SJM, CHRW and NDSN. The average dividend among the aristocrats is only 2.6%, but the higher yielding names (MMM, LEG, WBA, VFC, IBM, O) pay >5%. The average aristocrat has been increasing dividends for 43 years and has a trailing P/E ratio of 24.

There is also a dividend aristocrat ETF (NOBL), which we don't like, given weightings and a low payout. We graph NOBL below vs the S&P 500 and the Russell 2000. It has outperformed both over the last 2 years.

Dividend Aristocrats (NOBL) vs. Russell 2000 (IWM)

Dividend Aristocrats (NOBL) vs. S&P 500 (SPY)

List sorted by Yield & P/E Available in Excel

Comments